Introduction

This definition of jobless, however, varies from country to country. For example, unemployment in the USA, which is a key indicator of the American economy, is determined through an index called the jobless rate whose calculation can be influenced by many variables.

I- The evolution of unemployment in the United States

The american jobless Rate represents the percentage of the total labor force that is unemployed but actively seeking work in the quarter preceding publication.

It is an indicator key to labor market performance, which represents a key statistic illustrating the percentage of the active workforce unemployed but looking for work.

It classifies as unemployed people aged under 16 who are unemployed, available for work, and who have actively sought employment during the last four weeks of the reference period in question.

As a result, a large number of “unemployed” people are not counted as “unemployed.” This indicator therefore does not reflect the many difficulties in accessing the labor market.

So,the rise in inactivity helps to explain the continued low level of jobless over the recent period because some job seekers are given a status other than that of unemployed.

For example, the consequences of prison policy also contribute to the decline in the labor force participation rate. Prisoners, who make up about 1% of the American population, are counted among the inactive.

This leads to putting the performance of the labour market into perspective, as the reduction in activity rates could have a negative impact on production and growth in the medium term.

In this sense, we can present the different measures of unemployment calculated by the Bureau of Labor Statistics (BLS) as follows :

- Official unemployment;

- Official unemployment + discouraged workers;

- Official unemployment + discouraged workers + people marginally attached to the labor market;

- Official unemployment + people marginally attached to the labor market + part-time for economic reasons.

It should be noted that the unemployment rate rose to 4.3%, bringing the number of unemployed to 7.4 million in August 2025, the highest level since fall 2021.

II- The causes of unemployment in the USA

The unemployment rate is very sensitive to the economic situation. Thus,the American labor market is cracking under the effect of economic slowdown induced by Donald Trump’s protectionist offensive since his return to the White House, which has notably led companies to put investment projects on holdtime to see more clearly the level at which customs duties on products entering the United States will ultimately be.

Likewise, the reduction in migratory flows following restrictive immigration policy led by the Trump administration, which has weighed heavily on economic growth, leading to a rise in the unemployment rate.

Moreover, job creation was concentrated in local government and health, while jobs continued to be destroyed at the federal level, in line with the wishes of the Republican government.

III- The FED’s measures against unemployment

To control the level of inflation and unemployment, the American central bank also called the Federal Reserve (Fed) uses monetary policy as a tool to ensure full employment and price stability through changes in the key rate.

So, when unemployment rises, it can lower its rate to stimulate the economy, but when prices rise, it can on the contrary increase its key rate to slow activity and limit the runaway.

But when both elements deteriorate at the same time, it must choose between accepting higher prices or seeing people lose their jobs.

IV- Unemployment insurance in the United States

The law on jobless insurance was first adopted in the state of Wisconsin in the United States in 1932, during the Great Depression, when the unemployment rate continued to rise and exceeded 25%.

Six other states adopted comparable laws before, in 1935, a text profoundly modified the unemployment insurance system in force in the United States : the Social Security Act, which then laid the foundations of the American social security system.

Indeed, unemployment benefits provide insurance against the risk of job and income loss. The transition from employment to unemployment involves a loss of income that unemployment insurance helps to compensate for, at least in part.

It’s worth noting that there isn’t one unemployment insurance scheme, but 53. The federal government sets the framework, and each state defines specific rules regarding contribution rates, the amount of benefits paid to job seekers, and the duration of compensation. However, they have one major commonality : the rules adapt to the economic situation.

It should be noted that unemployment insurance schemes are mainly financed by employer contributions deducted from wages. The contribution rate varies according to several criteria. First, at the level of each company, depending on the history of layoffs : the more a company lays off employees, the higher its contribution rate; this is the principle of Experience Rating.

Moreover, the American unemployment insurance system is distinguished by two levels of governance :

1- Federal

The federal state defines framework laws, monitors the performance of states and finances the administration of the system.

2- State

The main operation of the unemployment insurance system is managed at the level of each State via the “State Workforce Agency” which ensures the collection of contributions, the monitoring of the eligibility of beneficiaries and the payment of benefits.

V- Eligibility for unemployment insurance

In order to be eligible for unemployment insurance, jobless claims must meet the specific conditions of each State.

In general, all states require at least three main conditions :

- Being involuntarily deprived of employment;

- Provide proof of a certain length of previous activity and certain income during the reference period;

- Be able to work, available for work and actively seeking employment.

In most states, the maximum duration for which a job seeker can receive benefits is 26 weeks (6 months). However, this duration can vary between 12 weeks (in Florida and North Carolina) and 30 weeks (in Massachusetts). In most states, the duration of benefits also varies depending on previous earnings.

Conclusion

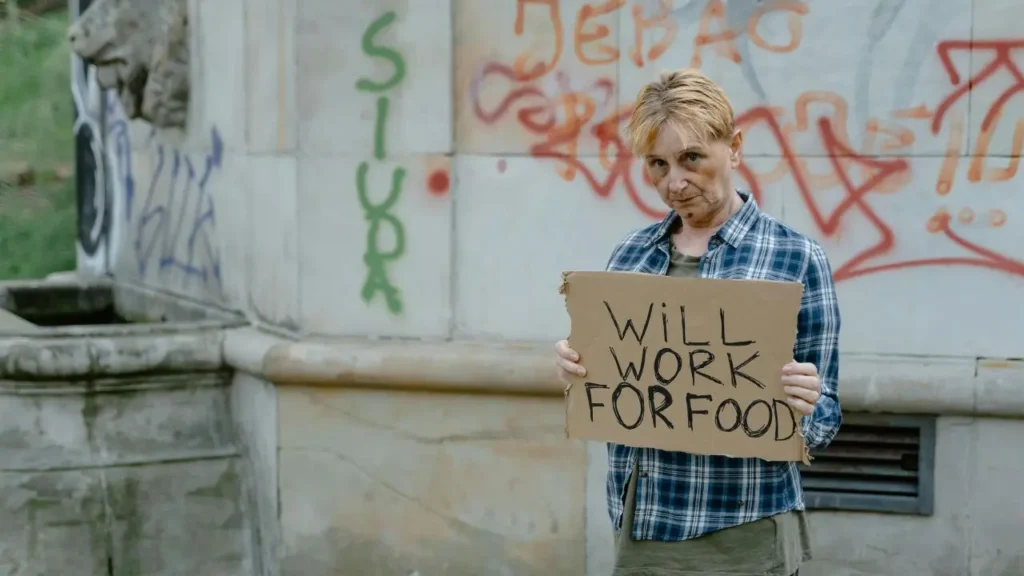

Disability insurance serves as a safety net for people who have difficulty finding employment. This process is not only the result of a relaxation of eligibility criteria, but also illustrates the difficulties unskilled workers face in finding employment.

pqyvkk

04ushv

jxebbz

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**glpro**

glpro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**vittaburn**

vittaburn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**sleeplean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**yu sleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**pinealxt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**potent stream**

potent stream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

**hepatoburn**

hepatoburn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

**hepato burn**

hepato burn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

**flowforce max**

flowforce max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**neuro genica**

neuro genica is a dietary supplement formulated to support nerve health and ease discomfort associated with neuropathy.

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

order cannabis gummies delivered safely to your door

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you

welcome

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/pl/register?ref=UM6SMJM3

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

welcome

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

welcome

Excellent pieces. Keep writing such kind of info on your blog. Im really impressed by your blog.

Thank you, that is kind of you

Wow, that’s what I was searching for, what a information! present here at this blog, thanks admin of this web site.

Hurrah, that’s what I was exploring for, what a data! present here at this webpage, thanks admin of this web page.

thanks

Wow, that’s what I was exploring for, what a information! existing here at this webpage, thanks admin of this site.

Thank you, that is kind of you

Wow, that’s what I was seeking for, what a stuff! existing here at this blog, thanks admin of this web page.

Wow, that’s what I was seeking for, what a data! existing here at this blog, thanks admin of this web site.

Wow, that’s what I was looking for, what a material! existing here at this webpage, thanks admin of this site.

Wow, that’s what I was searching for, what a data! present here at this blog, thanks admin of this site.

Wow, that’s what I was searching for, what a information! present here at this webpage, thanks admin of this site.

thanks

Hurrah, that’s what I was seeking for, what a material! existing here at this web site, thanks admin of this web site.

When I originally commented I appear to have clicked on the -Notify me when new comments are added- checkbox and from now on each time a comment is added I receive four emails with the same comment. Is there a means you are able to remove me from that service? Appreciate it!

When I initially commented I appear to have clicked on the -Notify me when new comments are added- checkbox and now whenever a comment is added I receive four emails with the exact same comment. There has to be a way you are able to remove me from that service? Appreciate it!

After I initially left a comment I seem to have clicked on the -Notify me when new comments are added- checkbox and now each time a comment is added I recieve four emails with the exact same comment. There has to be a way you can remove me from that service? Many thanks!

When I initially left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I recieve four emails with the exact same comment. Is there an easy method you are able to remove me from that service? Kudos!

When I initially commented I seem to have clicked the -Notify me when new comments are added- checkbox and now whenever a comment is added I receive 4 emails with the exact same comment. There has to be an easy method you are able to remove me from that service? Many thanks!

After I originally left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and from now on whenever a comment is added I get 4 emails with the exact same comment. Is there a way you can remove me from that service? Cheers!

When I originally commented I appear to have clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Perhaps there is a way you are able to remove me from that service? Appreciate it!

When I initially commented I appear to have clicked the -Notify me when new comments are added- checkbox and from now on every time a comment is added I receive four emails with the exact same comment. Is there an easy method you are able to remove me from that service? Thanks a lot!

What’s Happening i am new to this, I stumbled upon this I have found It positively helpful and it has aided me out loads. I’m hoping to give a contribution & aid other users like its helped me. Great job.

thank you, that is kind of you

I’m impressed, I must say. Seldom do I encounter a blog that’s both equally educative and amusing, and let me tell you, you’ve hit the nail on the head. The problem is something not enough folks are speaking intelligently about. I’m very happy I stumbled across this in my hunt for something relating to this.

Now I am going away to do my breakfast, once having my breakfast coming yet again to read additional news.

When someone writes an article he/she keeps the idea of a user in his/her mind that how a user can be aware of it. Therefore that’s why this piece of writing is perfect. Thanks!

thank you

I think the admin of this web page is genuinely working hard in support of his web site, because here every material is quality based information.

thank you, that is kind of you

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Hi, I think your blog might be having browser compatibility issues. When I look at your blog site in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, wonderful blog!

thank you

Helpful info. Fortunate me I found your website accidentally, and I am surprised why this twist of fate didn’t came about earlier! I bookmarked it.

thank you

Wow, incredible blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your site is wonderful, let alone the content!

thank you

If you desire to get a good deal from this piece of writing then you have to apply such methods to your won weblog.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why waste your intelligence on just posting videos to your weblog when you could be giving us something informative to read?

thanks

Right here is the perfect web site for everyone who hopes to understand this topic. You know a whole lot its almost tough to argue with you (not that I really would want to…HaHa). You definitely put a fresh spin on a topic that has been discussed for decades. Great stuff, just wonderful!

thank you very much

Quality articles or reviews is the crucial to be a focus for the people to pay a quick visit the website, that’s what this website is providing.

thank you

Oh my goodness! Impressive article dude! Thanks, However I am experiencing issues with your RSS. I don’t know the reason why I can’t subscribe to it. Is there anyone else having similar RSS problems? Anyone that knows the solution can you kindly respond? Thanks!!

If you would like to increase your familiarity only keep visiting this web page and be updated with the hottest news posted here.

thank you

I seriously love your site.. Pleasant colors & theme. Did you build this web site yourself? Please reply back as I’m attempting to create my own personal blog and would love to learn where you got this from or what the theme is named. Many thanks!

I think this is one of the such a lot important info for me. And i am glad studying your article. However wanna commentary on some normal things, The website taste is ideal, the articles is actually excellent : D. Just right task, cheers

thank you

I’m impressed, I must say. Rarely do I encounter a blog that’s equally educative and amusing, and without a doubt, you’ve hit the nail on the head. The issue is an issue that not enough people are speaking intelligently about. I’m very happy that I came across this during my hunt for something relating to this.

Thank you very much