Introduction

Inflation is one of the economic phenomena that has attracted significant attention recently, particularly with its exacerbation as a result of rising global demand, which has been sapped by household savings, supported by government subsidies provided after the end of the COVID-19 pandemic.

The pandemic had paralyzed the global economy and plunged it into a severe recession due to the lockdown policies implemented by countries to limit the spread of the virus, which led to disruptions in supply chains.

However, the global economic recovery was hampered by the Ukrainian-Russian war and the problems it caused in food supply and a shortage in the supply of energy to the market, which led to an increase in its prices.

This increase was reflected in the rest of the goods and commodities, causing inflation to reach unprecedented rates that had a negative impact on the economic and social situation of countries, such as a decline in economic growth, an increase in unemployment, and a deterioration in the purchasing power of citizens, which created a state of social congestion that threatened the social peace of countries.

What inflation meaning

Inflation is a sustained and significant rise in the general level of prices over a specific period of time. With a decrease in purchasing power. The average prices of goods and services consumed in the economy during a given year, calculated using a standardized index called the general price index. Talking about inflation requires examining three key elements :

- Increase in the general price level

- The rise continues in time.

- Demand is greater than supply

Accordingly, the rise in the price of some goods but not others is not considered inflation because in this case, any increase in the price of some goods is offset by a decrease in the price of other goods, making the overall price level stable.

Therefore, inflation refers to an increase in the prices of most goods and services, particularly basic commodities, which constitute a significant portion of the consumer’s budget.

Also, a temporary rise in prices is not considered inflation because it is not continuous over time.

Types of inflation

1- Inflation Open

It is the overt or apparent inflation, and this rise in prices occurs in response to increased demand, meaning that prices rise to achieve balance between supply and demand without the state intervening in this process.

2- Suppressed inflation

It is the restricted or latent inflation, which is the inflation under which prices cannot expand or rise due to the presence of direct restrictions placed to control price increases through pricing or forced ceilings. Prices rise as soon as the restrictions are lifted.

This type of inflation results in :

- Decrease in product quality with constant price ;

- Administrative price fixing may lead to the emergence of a black market.

3- Hyperinflation

It is the large increase and sharp rise in prices followed by a similar increase in wages, which in turn leads to an increase in production costs. This results in a decrease in the investor’s profits, so he in turn increases prices to maintain his profit margin.

This increase in prices leads to demands to raise wages, which puts the economy in what is called the vicious cycle of inflation.It should be noted that this type of inflation is characterized by very strong inflation that occurs over a short period of time, which may result in a sharp decline in the currency and even its collapse.

4- Rapid inflation

It is a rapid rise in the general level of prices over a medium period of time, leading to a deterioration in the value of the currency.

5- Moderate inflation

It is an increase in the general level of prices at a constant rate over time that may lead to a decrease in the value of the currency in the future.

6- Creeping inflation

It is less dangerous to the national economy than hyperinflation because it is slow and gradual, and occurs over a long period of time. This type of inflation causes a decline in the value of the currency over a long period.

Causes of inflation

1- Economic growth

It is an important incentive for the emergence of inflation, as increased economic growth raises labor employment rates and thus increases the wage bill, which stimulates domestic demand, resulting in a rise in prices.

2- Inflation forecast

The psychological factor of anticipating inflation leads to an increase in current demand to avoid future price increases. This increase in demand leads to higher inflation rates.

3- Natural disasters and monopoly

These two factors lead to a reduction in the supply of goods and services and their insufficiency in meeting demand, resulting in an increase in prices according to the principle of the law of supply and demand.

4- Aggregate supply shortage

The rise in costs, primarily represented by increased wages and the increase in the prices of production requirements, leads to an increase in expenditures and thus a decrease in aggregate supply.

This situation is characterized by the occurrence of inflation and unemployment simultaneously in a phenomenon known as stagflation or inflation depression.

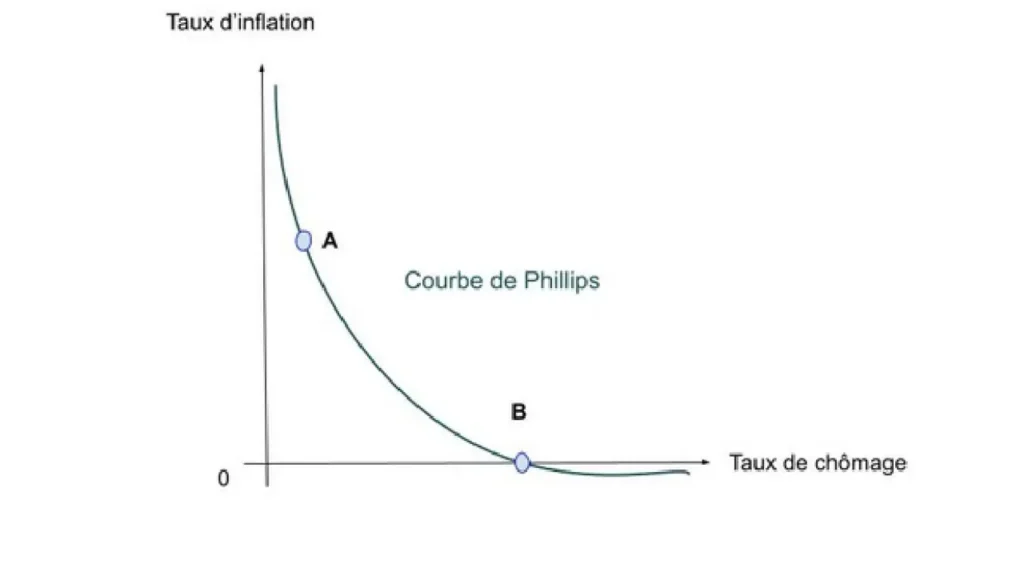

It should be noted that stagflation is a rare and abnormal phenomenon in the economic situation, given that the relationship between inflation and unemployment is an inverse relationship, meaning that : when unemployment was high, wages increased slowly; when unemployment was low, wages rose rapidly, as shown below in the Phillips Curve :

5- Restructuring the economy

Inflation may be linked to the nature of the structure of the production apparatus and the structure of the existing economic system. The structural aspects of the economy vary and take various forms. For example, we find :

- The low elasticity of the productive apparatus represented by the inability of the supply structure to change to match the demand structure ;

- Poor productivity ;

- The dominance of the rentier economy ;

- Lack of competition ;

- The economy is at the beginning of the development process, by focusing on infrastructure.

Sources of inflation

1- Cost-push inflation

It is the inflation that occurs when the prices of consumer and industrial goods continue to rise as a result of increased production costs resulting from the rise in the costs of production factors in economic institutions.

2- Demand-pull inflation

It occurs when prices rise as a result of an excess of aggregate demand over aggregate supply, whether in the goods market or the factors of production. When full employment is reached, the increase in demand and spending leads to an increase in prices to meet the excess of society’s productive capacity.

3- Inflation caused by the economic blockade

As a result of the blockade that a country may be subjected to for one reason or another, which prevents it from being able to import goods and merchandise from abroad, this will cause a shortage of products and consequently a rise in prices and the occurrence of inflation.

4- Inflation caused by monetary issuance

It arises as a result of an imbalance between the amount of money in circulation and the volume of goods and services offered. A large increase in the money supply compared to the volume of goods and services available in the national economy leads to an increase in prices and the occurrence of inflation.

5- Inflation source

The rise in prices is caused by an increase in the central bank’s dollar reserves, resulting from the existence of what is known as the dollar payment rule.

6- Borrowing-induced inflation

In an attempt to pay off its debts, the government may be forced to print more money without increasing production, which increases the money supply and generates inflation.

The government’s resort to raising taxes to increase its revenues may push companies to raise their prices to compensate for the tax rate imposed on them, thus causing inflation.

7- Inflation resulting from the entry of money from unknown sources and through illegal means

Money laundering and the resulting purchasing power for its owners, who are an unproductive group, puts pressure on the supply of goods by increasing consumption rates. This increased demand leads to higher prices.

8- Imported inflation

It occurs when prices rise as a result of the flow of global inflation into the country through imports. That is, if a country suffers from inflation, imports from this country will inevitably transfer this inflation to the local economy through imported goods and services.

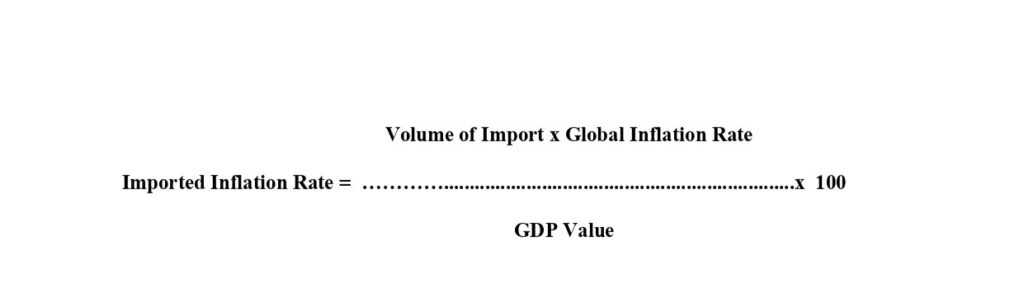

This transfer is not total, but rather according to the volume of imports, which is expressed by the following equation :

This equation expresses that the Imported Inflation Rate increases with the increase in the volume of imports.

Conclusion

The views of economic experts have varied greatly in their dealing with the phenomenon of economic inflation, in terms of explanation and analysis, as well as ways to treat it, and attributed to the difference is due to the multiplicity of their orientations and the economic schools whose proposals they adopt.

For example, we find the quantity theory of money, it stipulates that the increase in the amount of money circulating in the market is the reason for the emergence of signs of inflation.

At the time you see Keynesian theory Inflation is an increase in purchasing power that is not matched by an increase in production, or an increase in real demand in an environment where all means of production are fully utilized. Then there is the contemporary quantity theory of money, whose proponents are called monetarists.

Milton Friedman is considered one of the fathers of this school, which holds that inflation is a purely monetary phenomenon, and its primary source is the growth of the money supply faster than production.

Приглашаем вас в путешествие по Уралу! Здесь вы найдете все, что нужно знать о подготовке к пешему походу.

Между прочим, если вас интересует Традиционные шаманские ритуалы Республики Тыва, посмотрите сюда.

Ссылка ниже:

https://rustrail.ru/%d1%80%d0%b5%d1%81%d0%bf%d1%83%d0%b1%d0%bb%d0%b8%d0%ba%d0%b0-%d1%82%d1%8b%d0%b2%d0%b0-%d0%b8-%d0%b5%d1%91-%d1%88%d0%b0%d0%bc%d0%b0%d0%bd%d1%81%d0%ba%d0%b8%d0%b5-%d1%80%d0%b8%d1%82%d1%83%d0%b0%d0%bb/

После прочтения этой статьи, вы точно будете готовы к пешему походу по Уралу.

Долго искал решение и наконец-то нашел:

Между прочим, если вас интересует localflavors.ru, посмотрите сюда.

Вот, делюсь ссылкой:

https://localflavors.ru

Спасибо, что дочитали до конца.

Чтобы не быть голословным, прикрепляю ссылку:

Хочу выделить раздел про eqa.ru.

Смотрите сами:

https://eqa.ru

Спасибо за внимание.

Всем привет, нашел интересную информацию по теме:

Кстати, если вас интересует komandor-povolje.ru, посмотрите сюда.

Вот, можете почитать:

https://komandor-povolje.ru

Что думаете по этому поводу?

Кстати, вот что я думаю по этому поводу:

По теме “yogapulse.ru”, нашел много полезного.

Смотрите сами:

https://yogapulse.ru

Дайте знать, если найдете что-то еще.

Согласен с предыдущим оратором, и в дополнение хочу сказать:

Для тех, кто ищет информацию по теме “yogapulse.ru”, там просто кладезь информации.

Вот, делюсь ссылкой:

https://yogapulse.ru

Жду конструктивной критики.

Согласен с предыдущим оратором, и в дополнение хочу сказать:

Для тех, кто ищет информацию по теме “komandor-povolje.ru”, нашел много полезного.

Вот, делюсь ссылкой:

https://komandor-povolje.ru

Спасибо, что дочитали до конца.

Вот, что говорят эксперты по этому поводу:

По теме “fk-almazalrosa.ru”, есть отличная статья.

Ссылка ниже:

https://fk-almazalrosa.ru

Интересно было бы узнать ваше мнение.

Долго искал решение и наконец-то нашел:

Особенно понравился раздел про raregreen.ru.

Смотрите сами:

https://raregreen.ru

Надеюсь, смог помочь.

Вот здесь можно найти больше примеров:

Для тех, кто ищет информацию по теме “avelonbeta.ru”, нашел много полезного.

Ссылка ниже:

https://avelonbeta.ru

Надеюсь, смог помочь.

Вот здесь можно найти больше примеров:

Для тех, кто ищет информацию по теме “avelonbeta.ru”, там просто кладезь информации.

Вот, можете почитать:

https://avelonbeta.ru

Всем спасибо, и до новых встреч!

Это именно то, что я искал!

Зацепил материал про lingomap.ru.

Ссылка ниже:

https://lingomap.ru

Поделитесь своими мыслями в комментариях.

Долго искал решение и наконец-то нашел:

Для тех, кто ищет информацию по теме “m-admin.ru”, есть отличная статья.

Вот, можете почитать:

https://m-admin.ru

Надеюсь, смог помочь.

Если нужна более подробная инструкция, то она здесь:

Для тех, кто ищет информацию по теме “clasifieds.ru”, там просто кладезь информации.

Ссылка ниже:

https://clasifieds.ru

Спасибо, что дочитали до конца.

Готовы открыть для себя мир необычных фруктов и овощей?

Между прочим, если вас интересует Секреты цейлонской корицы из Шри-Ланки, загляните сюда.

Смотрите сами:

https://localflavors.ru/%d0%ba%d0%be%d1%80%d0%b8%d1%86%d0%b0-%d1%88%d1%80%d0%b8-%d0%bb%d0%b0%d0%bd%d0%ba%d0%b0-%d0%b2-%d1%87%d1%91%d0%bc-%d1%81%d0%b5%d0%ba%d1%80%d0%b5%d1%82-%d0%b5%d1%91-%d1%81%d0%bb%d0%b0%d0%b4%d0%ba/

Если у вас есть собственные советы, не стесняйтесь делиться ими в комментариях.

Пытаетесь разнообразить своё питание необычными вкусами? Мы подскажем, как это сделать!

Между прочим, если вас интересует Экзотические продукты Латинской Америки: что попробовать?, посмотрите сюда.

Вот, делюсь ссылкой:

https://localflavors.ru/%d1%80%d1%8b%d0%bd%d0%ba%d0%b8-%d1%8d%d0%ba%d0%b7%d0%be%d1%82%d0%b8%d1%87%d0%b5%d1%81%d0%ba%d0%b8%d1%85-%d0%bf%d1%80%d0%be%d0%b4%d1%83%d0%ba%d1%82%d0%be%d0%b2-%d0%b2-%d0%bb%d0%b0%d1%82%d0%b8%d0%bd/

Если у вас есть собственные советы, не стесняйтесь делиться ими в комментариях.

Вы не знаете, как хранить экзотические продукты? У нас есть несколько советов!

Зацепил раздел про Откройте мир уникальных чайных смесей и вкусов.

Вот, делюсь ссылкой:

https://localflavors.ru/%d1%87%d0%b0%d0%b9%d0%bd%d1%8b%d0%b5-%d1%81%d0%bc%d0%b5%d1%81%d0%b8-%d1%81-%d0%bd%d0%b5%d0%be%d0%b1%d1%8b%d1%87%d0%bd%d1%8b%d0%bc%d0%b8-%d0%b4%d0%be%d0%b1%d0%b0%d0%b2%d0%ba%d0%b0%d0%bc%d0%b8/

Удачи в кулинарных экспериментах с экзотическими продуктами!

Незнакомые названия и странные формы — экзотические продукты всегда манят.

Для тех, кто ищет информацию по теме “Спасение местных деликатесов: угрозы и решения”, нашел много полезного.

Ссылка ниже:

https://localflavors.ru/%d0%bc%d0%b5%d1%81%d1%82%d0%bd%d1%8b%d0%b5-%d0%b4%d0%b5%d0%bb%d0%b8%d0%ba%d0%b0%d1%82%d0%b5%d1%81%d1%8b-%d0%bf%d0%be%d0%b4-%d1%83%d0%b3%d1%80%d0%be%d0%b7%d0%be%d0%b9-%d0%b8%d1%81%d1%87%d0%b5%d0%b7/

Если у вас есть собственные советы, не стесняйтесь делиться ими в комментариях.

Вы не знаете, как хранить экзотические продукты? У нас есть несколько советов!

Кстати, если вас интересует Скрытые тайны традиционных напитков 2025, посмотрите сюда.

Вот, делюсь ссылкой:

https://localflavors.ru/%d1%82%d1%80%d0%b0%d0%b4%d0%b8%d1%86%d0%b8%d0%be%d0%bd%d0%bd%d1%8b%d0%b5-%d0%bd%d0%b0%d0%bf%d0%b8%d1%82%d0%ba%d0%b8-%d1%81-%d1%80%d0%b5%d0%b4%d0%ba%d0%b8%d0%bc%d0%b8-%d0%b8%d0%bd%d0%b3%d1%80%d0%b5/

Желаем вам новых открытий и ярких вкусов!

Эти экзотические фрукты и овощи сделают ваше меню более ярким и насыщенным.

Кстати, если вас интересует Откройте редкие и необычные чаи Азии, посмотрите сюда.

Ссылка ниже:

https://localflavors.ru/%d0%bd%d0%b5%d0%be%d0%b1%d1%8b%d1%87%d0%bd%d1%8b%d0%b5-%d1%81%d0%be%d1%80%d1%82%d0%b0-%d1%87%d0%b0%d1%8f-%d0%b8%d0%b7-%d0%b0%d0%b7%d0%b8%d0%b8/

Пусть ваши блюда всегда будут полны экзотики и оригинальности.

Готовы открыть для себя мир необычных фруктов и овощей?

Особенно понравился материал про Античные специи: История и современное применение.

Вот, можете почитать:

https://localflavors.ru/%d0%b0%d0%bd%d1%82%d0%b8%d1%87%d0%bd%d1%8b%d0%b5-%d1%81%d0%bf%d0%b5%d1%86%d0%b8%d0%b8-%d0%b2%d0%be%d0%b7%d0%b2%d1%80%d0%b0%d1%89%d0%b5%d0%bd%d0%b8%d0%b5-%d0%b2-%d0%bc%d0%b5%d0%bd%d1%8e/

Если у вас есть собственные советы, не стесняйтесь делиться ими в комментариях.

Пытаетесь разнообразить своё питание необычными вкусами? Мы подскажем, как это сделать!

Между прочим, если вас интересует Как специи изменяли мировую историю и экономику, посмотрите сюда.

Вот, можете почитать:

https://localflavors.ru/%d1%81%d0%bf%d0%b5%d1%86%d0%b8%d0%b8-%d0%ba%d0%be%d1%82%d0%be%d1%80%d1%8b%d0%b5-%d0%b8%d0%b7%d0%bc%d0%b5%d0%bd%d0%b8%d0%bb%d0%b8-%d1%85%d0%be%d0%b4-%d0%b8%d1%81%d1%82%d0%be%d1%80%d0%b8%d0%b8/

Пусть ваши блюда всегда будут полны экзотики и оригинальности.

Эти экзотические фрукты и овощи сделают ваше меню более ярким и насыщенным.

Между прочим, если вас интересует Откройте для себя редкие морепродукты и их бизнес-потенциал, загляните сюда.

Вот, делюсь ссылкой:

https://localflavors.ru/%d1%80%d0%b5%d0%b4%d0%ba%d0%b8%d0%b5-%d0%b4%d0%b5%d0%bb%d0%b8%d0%ba%d0%b0%d1%82%d0%b5%d1%81%d1%8b-%d0%b8%d0%b7-%d0%bc%d0%be%d1%80%d0%b5%d0%bf%d1%80%d0%be%d0%b4%d1%83%d0%ba%d1%82%d0%be%d0%b2/

Удачи в кулинарных экспериментах с экзотическими продуктами!

Готовы открыть для себя мир необычных фруктов и овощей?

Для тех, кто ищет информацию по теме “Кардамон из Гватемалы: Использование в выпечке и влияние на рынок”, нашел много полезного.

Ссылка ниже:

https://localflavors.ru/%d0%ba%d0%b0%d1%80%d0%b4%d0%b0%d0%bc%d0%be%d0%bd-%d0%b3%d0%b2%d0%b0%d1%82%d0%b5%d0%bc%d0%b0%d0%bb%d0%b0-%d0%b4%d0%bb%d1%8f-%d1%87%d0%b5%d0%b3%d0%be-%d0%b8%d1%81%d0%bf%d0%be%d0%bb%d1%8c%d0%b7%d1%83/

Удачи в кулинарных экспериментах с экзотическими продуктами!

Эти экзотические фрукты и овощи сделают ваше меню более ярким и насыщенным.

Кстати, если вас интересует История и значение специй в культурах мира, посмотрите сюда.

Вот, можете почитать:

https://localflavors.ru/%d1%82%d1%80%d0%b0%d0%b4%d0%b8%d1%86%d0%b8%d0%b8-%d0%b8%d1%81%d0%bf%d0%be%d0%bb%d1%8c%d0%b7%d0%be%d0%b2%d0%b0%d0%bd%d0%b8%d1%8f-%d1%81%d0%bf%d0%b5%d1%86%d0%b8%d0%b9-%d0%b2-%d1%80%d0%b0%d0%b7%d0%bd/

Пусть ваши блюда всегда будут полны экзотики и оригинальности.

Эти экзотические фрукты и овощи сделают ваше меню более ярким и насыщенным.

Между прочим, если вас интересует Бадьян из Китая: секрет анисового вкуса, посмотрите сюда.

Смотрите сами:

https://localflavors.ru/%d0%b1%d0%b0%d0%b4%d1%8c%d1%8f%d0%bd-%d0%ba%d0%b8%d1%82%d0%b0%d0%b9-%d0%ba%d0%b0%d0%ba-%d0%be%d0%bd-%d0%bf%d1%80%d0%b8%d0%b4%d0%b0%d1%91%d1%82-%d0%b1%d0%bb%d1%8e%d0%b4%d0%b0%d0%bc-%d0%b0%d0%bd/

Теперь вам осталось только отправиться в магазин за экзотикой. Приятных покупок!

Вот здесь подробно расписано, как это сделать:

Для тех, кто ищет информацию по теме “anclaves.ru”, есть отличная статья.

Смотрите сами:

https://anclaves.ru

Всем удачи и хорошего дня!

На мой взгляд, лучшее решение этой проблемы здесь:

Для тех, кто ищет информацию по теме “localflavors.ru”, нашел много полезного.

Вот, можете почитать:

https://localflavors.ru

Всем мира и продуктивного дня

Наткнулся на полезную статью, думаю, вам тоже пригодится:

Для тех, кто ищет информацию по теме “diyworks.ru”, нашел много полезного.

Ссылка ниже:

https://diyworks.ru

Спасибо за внимание.

Вот тут есть все ответы на ваши вопросы:

Особенно понравился раздел про lingomap.ru.

Смотрите сами:

[url=https://lingomap.ru]https://lingomap.ru[/url]

Жду конструктивной критики.

Для тех, кто в теме, будет очень актуально:

По теме “yogapulse.ru”, есть отличная статья.

Вот, делюсь ссылкой:

https://yogapulse.ru

Какие еще есть варианты?

Для тех, кто в теме, будет очень актуально:

Зацепил материал про hotelnews.ru.

Вот, делюсь ссылкой:

https://hotelnews.ru

Рад был поделиться информацией.

Чтобы разобраться в вопросе, рекомендую ознакомиться:

Особенно понравился раздел про komandor-povolje.ru.

Ссылка ниже:

https://komandor-povolje.ru

Может, у кого-то есть другой опыт?

Как раз то, что нужно для решения этого вопроса:

Особенно понравился материал про travelmontenegro.ru.

Вот, можете почитать:

https://travelmontenegro.ru

Рад был поделиться информацией.

Долго искал решение и наконец-то нашел:

Кстати, если вас интересует diyworks.ru, посмотрите сюда.

Вот, делюсь ссылкой:

https://diyworks.ru

Надеюсь, у вас все получится.

Исчерпывающий ответ на данный вопрос находится тут:

Между прочим, если вас интересует easyterm.ru, загляните сюда.

Смотрите сами:

https://easyterm.ru

Интересно было бы узнать ваше мнение.

Как раз то, что нужно для решения этого вопроса:

Особенно понравился раздел про travelcrimea.ru.

Ссылка ниже:

https://travelcrimea.ru

Какие еще есть варианты?

Полностью поддерживаю, и вот еще одно подтверждение:

Зацепил раздел про mersobratva.ru.

Вот, можете почитать:

https://mersobratva.ru

Может, у кого-то есть другой опыт?

Долго искал решение и наконец-то нашел:

Между прочим, если вас интересует parkpodarkov.ru, загляните сюда.

Смотрите сами:

https://parkpodarkov.ru

Что думаете по этому поводу?

Давайте подведем итоги марта и посмотрим, какие темы стали самыми популярными.

По теме “Ежедневный гороскоп на 31 июля 2025 года”, есть отличная статья.

Смотрите сами:

http://mamas.ru/horoscopes.php

Маркет продолжается, и впереди еще больше интересных тем для обсуждения.

Настоящий обзор самых популярных обсуждений марта на Mamas.Ru для вас!

Кстати, если вас интересует Обсуждаем последние записи в дневниках мам, посмотрите сюда.

Вот, можете почитать:

http://mamas.ru/blog.php

Надеюсь, вы нашли что-то полезное для себя. До следующего месяца!

Какой месяц выдался на Mamas.Ru! Давайте вместе посмотрим, о чем говорили в марте.

Между прочим, если вас интересует Обсуждаем флеш-игры и турниры для всех, загляните сюда.

Смотрите сами:

http://mamas.ru/arcade.php

Большое спасибо за ваше внимание! Наверняка в следующем месяце будет еще больше интересного.

Настоящий обзор самых популярных обсуждений марта на Mamas.Ru для вас!

По теме “Популярные рецепты и кулинарные советы”, там просто кладезь информации.

Вот, можете почитать:

http://mamas.ru/recepty.php

Это были самые горячие обсуждения марта. Ждем вас с новыми темами в следующем месяце.

Представляем самые читаемые и обсуждаемые темы марта на Mamas.Ru.

Кстати, если вас интересует Популярные рецепты и кулинарные советы, загляните сюда.

Вот, делюсь ссылкой:

http://mamas.ru/recepty.php

Маркет продолжается, и впереди еще больше интересных тем для обсуждения.

Какой месяц выдался на Mamas.Ru! Давайте вместе посмотрим, о чем говорили в марте.

Между прочим, если вас интересует Обсуждение активности на сайте для мам, посмотрите сюда.

Смотрите сами:

http://mamas.ru/activity.php

Это были самые горячие обсуждения марта. Ждем вас с новыми темами в следующем месяце.

Какой месяц выдался на Mamas.Ru! Давайте вместе посмотрим, о чем говорили в марте.

Зацепил раздел про Популярные рецепты и кулинарные советы.

Вот, можете почитать:

http://mamas.ru/recepty.php

Большое спасибо за ваше внимание! Наверняка в следующем месяце будет еще больше интересного.

Давайте подведем итоги марта и посмотрим, какие темы стали самыми популярными.

Между прочим, если вас интересует Обсуждаем флеш-игры и турниры для всех, загляните сюда.

Вот, делюсь ссылкой:

http://mamas.ru/arcade.php

Маркет продолжается, и впереди еще больше интересных тем для обсуждения.

Мамочки, делимся новостями на Mamas.Ru. Какие темы вас особенно заинтересовали в марте?

Для тех, кто ищет информацию по теме “Ежедневный гороскоп на 31 июля 2025 года”, там просто кладезь информации.

Смотрите сами:

http://mamas.ru/horoscopes.php

Большое спасибо за ваше внимание! Наверняка в следующем месяце будет еще больше интересного.

Настоящий обзор самых популярных обсуждений марта на Mamas.Ru для вас!

Кстати, если вас интересует Ежедневный гороскоп на 31 июля 2025 года, посмотрите сюда.

Смотрите сами:

http://mamas.ru/horoscopes.php

Маркет продолжается, и впереди еще больше интересных тем для обсуждения.

Добро пожаловать на Mamas.Ru! Сегодня мы обсудим самые горячие темы нашего сообщества в марте.

Хочу выделить материал про Общение для мам: от ухода за детьми до хобби.

Ссылка ниже:

http://mamas.ru/forum.php

Надеюсь, вы нашли что-то полезное для себя. До следующего месяца!

Какой месяц выдался на Mamas.Ru! Давайте вместе посмотрим, о чем говорили в марте.

По теме “Популярные рецепты и кулинарные советы”, есть отличная статья.

Вот, делюсь ссылкой:

http://mamas.ru/recepty.php

Маркет продолжается, и впереди еще больше интересных тем для обсуждения.

Вот тут есть все ответы на ваши вопросы:

Кстати, если вас интересует musichunt.pro, загляните сюда.

Ссылка ниже:

https://musichunt.pro

Надеюсь, у вас все получится.

На мой взгляд, лучшее решение этой проблемы здесь:

Особенно понравился материал про easyterm.ru.

Ссылка ниже:

https://easyterm.ru

Какие еще есть варианты?

Делюсь с вами полезной ссылкой по теме:

Для тех, кто ищет информацию по теме “eqa.ru”, нашел много полезного.

Ссылка ниже:

https://eqa.ru

Какие еще есть варианты?

Как вариант, можно рассмотреть следующее:

Особенно понравился раздел про fjhg.ru.

Вот, можете почитать:

https://fjhg.ru

Давайте обсудим это подробнее.

Делюсь с вами полезной ссылкой по теме:

Зацепил материал про spb-hotels.ru.

Вот, делюсь ссылкой:

https://spb-hotels.ru

Всем спасибо, и до новых встреч!

Это именно то, что я искал!

По теме “mersobratva.ru”, там просто кладезь информации.

Смотрите сами:

https://mersobratva.ru

Какие еще есть варианты?

Это именно то, что я искал!

Между прочим, если вас интересует all-hotels-online.ru, посмотрите сюда.

Смотрите сами:

https://all-hotels-online.ru

Всем мира и продуктивного дня

Вот, что говорят эксперты по этому поводу:

Хочу выделить раздел про travelcrimea.ru.

Вот, делюсь ссылкой:

https://travelcrimea.ru

Дайте знать, если найдете что-то еще.

Как вариант, можно рассмотреть следующее:

Кстати, если вас интересует fk-almazalrosa.ru, посмотрите сюда.

Вот, можете почитать:

https://fk-almazalrosa.ru

Может, у кого-то есть другой опыт?

Вот отличный материал, который проливает свет на ситуацию:

Зацепил материал про lingomap.ru.

Ссылка ниже:

https://lingomap.ru

Пишите, что у вас получилось.

Вот отличный материал, который проливает свет на ситуацию:

Хочу выделить материал про all-hotels-online.ru.

Вот, можете почитать:

https://all-hotels-online.ru

Может, у кого-то есть другой опыт?

Кстати, вот что я думаю по этому поводу:

Хочу выделить раздел про detoxa.ru.

Ссылка ниже:

https://detoxa.ru

Всем спасибо, и до новых встреч!

Кстати, вот что я думаю по этому поводу:

Зацепил раздел про eroticpic.ru.

Вот, можете почитать:

https://eroticpic.ru

Буду следить за обсуждением.

Посмотрите, что я нашел по этому поводу:

Для тех, кто ищет информацию по теме “reactive.su”, нашел много полезного.

Вот, можете почитать:

https://reactive.su

Всем добра!

Чтобы не быть голословным, прикрепляю ссылку:

Кстати, если вас интересует all-hotels-online.ru, загляните сюда.

Ссылка ниже:

https://all-hotels-online.ru

Какие еще есть варианты?

Вот отличный материал, который проливает свет на ситуацию:

Особенно понравился раздел про obender.ru.

Ссылка ниже:

https://obender.ru

Спасибо, что дочитали до конца.

Как раз то, что нужно для решения этого вопроса:

Между прочим, если вас интересует travelcrimea.ru, загляните сюда.

Смотрите сами:

https://travelcrimea.ru

Дайте знать, если найдете что-то еще.

Посмотрите, что я нашел по этому поводу:

Особенно понравился раздел про classifields.ru.

Ссылка ниже:

https://classifields.ru

Успехов в решении вашего вопроса!

Если кому интересно, вот более детальная информация:

Кстати, если вас интересует obender.ru, посмотрите сюда.

Ссылка ниже:

https://obender.ru

Если у вас есть что добавить, не стесняйтесь.

Возможно, это будет полезно участникам обсуждения:

Для тех, кто ищет информацию по теме “easyterm.ru”, нашел много полезного.

Смотрите сами:

https://easyterm.ru

Всем мира и продуктивного дня

Очень рекомендую к прочтению:

Между прочим, если вас интересует m-admin.ru, посмотрите сюда.

Вот, можете почитать:

https://m-admin.ru

Рад был поделиться информацией.

Полностью поддерживаю, и вот еще одно подтверждение:

Особенно понравился материал про reactive.su.

Вот, делюсь ссылкой:

https://reactive.su

Всем удачи и хорошего дня!

Кстати, вот что я думаю по этому поводу:

Для тех, кто ищет информацию по теме “travelmontenegro.ru”, есть отличная статья.

Смотрите сами:

https://travelmontenegro.ru

Жду конструктивной критики.

Если нужна более подробная инструкция, то она здесь:

Для тех, кто ищет информацию по теме “cyq.ru”, там просто кладезь информации.

Ссылка ниже:

https://cyq.ru

Какие еще есть варианты?

Чтобы не быть голословным, прикрепляю ссылку:

Между прочим, если вас интересует pro-zenit.ru, загляните сюда.

Вот, делюсь ссылкой:

https://pro-zenit.ru

Успехов в решении вашего вопроса!

Для тех, кто в теме, будет очень актуально:

Зацепил материал про pro-zenit.ru.

Ссылка ниже:

https://pro-zenit.ru

Какие еще есть варианты?

Вот, что говорят эксперты по этому поводу:

Зацепил материал про komandor-povolje.ru.

Смотрите сами:

https://komandor-povolje.ru

Надеюсь, эта информация сэкономит вам время.

Согласен с предыдущим оратором, и в дополнение хочу сказать:

Особенно понравился раздел про fjhg.ru.

Смотрите сами:

https://fjhg.ru

Обращайтесь, если что.

Всем привет, нашел интересную информацию по теме:

Кстати, если вас интересует buytime.ru, посмотрите сюда.

Вот, можете почитать:

https://buytime.ru

Если у вас есть что добавить, не стесняйтесь.

Вот здесь можно найти больше примеров:

Особенно понравился раздел про fjhg.ru.

Ссылка ниже:

https://fjhg.ru

Рад был поделиться информацией.

Возможно, это будет полезно участникам обсуждения:

Для тех, кто ищет информацию по теме “idalgogrif.ru”, нашел много полезного.

Смотрите сами:

https://idalgogrif.ru

Буду рад, если кому-то пригодится.

Наткнулся на полезную статью, думаю, вам тоже пригодится:

Для тех, кто ищет информацию по теме “raregreen.ru”, нашел много полезного.

Вот, можете почитать:

https://raregreen.ru

Спасибо, что дочитали до конца.

Вот, что говорят эксперты по этому поводу:

Между прочим, если вас интересует buytime.ru, посмотрите сюда.

Ссылка ниже:

https://buytime.ru

Жду конструктивной критики.

Уверен, эта информация будет для вас полезна:

Зацепил раздел про detoxa.ru.

Ссылка ниже:

https://detoxa.ru

Пишите, что у вас получилось.

Согласен с предыдущим оратором, и в дополнение хочу сказать:

Кстати, если вас интересует tars-rubber.ru, посмотрите сюда.

Ссылка ниже:

https://tars-rubber.ru

Всем спасибо, и до новых встреч!

Если кому интересно, вот более детальная информация:

Между прочим, если вас интересует classifields.ru, посмотрите сюда.

Вот, можете почитать:

[url=https://classifields.ru]https://classifields.ru[/url]

Всем спасибо, и до новых встреч!

Согласен с предыдущим оратором, и в дополнение хочу сказать:

Кстати, если вас интересует eroticpic.ru, посмотрите сюда.

Вот, можете почитать:

https://eroticpic.ru

Спасибо за внимание.

Наткнулся на полезную статью, думаю, вам тоже пригодится:

Для тех, кто ищет информацию по теме “hotelnews.ru”, там просто кладезь информации.

Смотрите сами:

https://hotelnews.ru

Если есть вопросы, задавайте.

Как раз то, что нужно для решения этого вопроса:

Хочу выделить материал про rustrail.ru.

Вот, можете почитать:

https://rustrail.ru

Всем удачи и хорошего дня!

Вот здесь подробно расписано, как это сделать:

Кстати, если вас интересует avelonbeta.ru, загляните сюда.

Смотрите сами:

https://avelonbeta.ru

Всем добра!

На мой взгляд, лучшее решение этой проблемы здесь:

Между прочим, если вас интересует travelmontenegro.ru, посмотрите сюда.

Смотрите сами:

https://travelmontenegro.ru

Жду конструктивной критики.

Возможно, это будет полезно участникам обсуждения:

Хочу выделить раздел про raregreen.ru.

Вот, делюсь ссылкой:

https://raregreen.ru

Что думаете по этому поводу?

Давно слежу за этой темой, хочу поделиться находкой:

По теме “mersobratva.ru”, есть отличная статья.

Смотрите сами:

https://mersobratva.ru

Чем мог, тем помог.

На мой взгляд, лучшее решение этой проблемы здесь:

Хочу выделить раздел про spb-hotels.ru.

Вот, можете почитать:

https://spb-hotels.ru

Пишите, что у вас получилось.

Если кому интересно, вот более детальная информация:

Кстати, если вас интересует mersobratva.ru, загляните сюда.

Вот, можете почитать:

https://mersobratva.ru

Буду следить за обсуждением.

Полностью поддерживаю, и вот еще одно подтверждение:

Хочу выделить материал про classifields.ru.

Вот, можете почитать:

https://classifields.ru

Всем мира и продуктивного дня

Вот здесь можно найти больше примеров:

Особенно понравился раздел про clasifieds.ru.

Вот, можете почитать:

https://clasifieds.ru

Давайте обсудим это подробнее.

Давно слежу за этой темой, хочу поделиться находкой:

Для тех, кто ищет информацию по теме “m-admin.ru”, там просто кладезь информации.

Ссылка ниже:

https://m-admin.ru

Интересно было бы узнать ваше мнение.

На мой взгляд, лучшее решение этой проблемы здесь:

Особенно понравился материал про tars-rubber.ru.

Ссылка ниже:

https://tars-rubber.ru

Если у вас есть что добавить, не стесняйтесь.

Недавно столкнулся с похожей ситуацией, и вот что помогло:

Хочу выделить раздел про 095hotel.ru.

Вот, можете почитать:

[url=https://095hotel.ru]https://095hotel.ru[/url]

Всем мира и продуктивного дня

Вот, что говорят эксперты по этому поводу:

Хочу выделить раздел про idalgogrif.ru.

Вот, можете почитать:

https://idalgogrif.ru

Если у вас есть что добавить, не стесняйтесь.

Всем привет, нашел интересную информацию по теме:

Хочу выделить раздел про buytime.ru.

Смотрите сами:

https://buytime.ru

Надеюсь, эта информация сэкономит вам время.

Долго искал решение и наконец-то нашел:

Для тех, кто ищет информацию по теме “hotelnews.ru”, там просто кладезь информации.

Ссылка ниже:

https://hotelnews.ru

Рад был поделиться информацией.

Вот здесь можно найти больше примеров:

Зацепил материал про lingomap.ru.

Смотрите сами:

[url=https://lingomap.ru]https://lingomap.ru[/url]

Всем добра!

Полностью поддерживаю, и вот еще одно подтверждение:

По теме “cyq.ru”, нашел много полезного.

Вот, делюсь ссылкой:

https://cyq.ru

Надеюсь, это было полезно.

Чтобы разобраться в вопросе, рекомендую ознакомиться:

Хочу выделить материал про eroticpic.ru.

Вот, можете почитать:

https://eroticpic.ru

Буду рад, если кому-то пригодится.

Долго искал решение и наконец-то нашел:

Между прочим, если вас интересует clasifieds.ru, загляните сюда.

Ссылка ниже:

https://clasifieds.ru

Всем мира и продуктивного дня

Как вариант, можно рассмотреть следующее:

По теме “tars-rubber.ru”, там просто кладезь информации.

Ссылка ниже:

https://tars-rubber.ru

Поделитесь своими мыслями в комментариях.

Если нужна более подробная инструкция, то она здесь:

По теме “raregreen.ru”, там просто кладезь информации.

Вот, можете почитать:

https://raregreen.ru

Буду признателен за ваши отзывы.

Как вариант, можно рассмотреть следующее:

По теме “m-admin.ru”, там просто кладезь информации.

Вот, можете почитать:

https://m-admin.ru

Надеюсь, у вас все получится.

Исчерпывающий ответ на данный вопрос находится тут:

Для тех, кто ищет информацию по теме “komandor-povolje.ru”, есть отличная статья.

Вот, делюсь ссылкой:

https://komandor-povolje.ru

Успехов в решении вашего вопроса!

Делюсь с вами полезной ссылкой по теме:

Кстати, если вас интересует seatours.ru, загляните сюда.

Вот, можете почитать:

https://seatours.ru

Надеюсь, смог помочь.

Согласен с предыдущим оратором, и в дополнение хочу сказать:

Между прочим, если вас интересует hotelnews.ru, посмотрите сюда.

Смотрите сами:

https://hotelnews.ru

Пишите, что у вас получилось.

Это именно то, что я искал!

Кстати, если вас интересует fjhg.ru, загляните сюда.

Ссылка ниже:

https://fjhg.ru

Что думаете по этому поводу?

Если нужна более подробная инструкция, то она здесь:

Между прочим, если вас интересует spb-hotels.ru, посмотрите сюда.

Смотрите сами:

https://spb-hotels.ru

Надеюсь, смог помочь.

Всем привет, нашел интересную информацию по теме:

Между прочим, если вас интересует eroticpic.ru, посмотрите сюда.

Вот, делюсь ссылкой:

https://eroticpic.ru

Надеюсь, это было полезно.

Чтобы было понятнее, о чем речь:

По теме “fk-almazalrosa.ru”, есть отличная статья.

Смотрите сами:

https://fk-almazalrosa.ru

Пишите, что у вас получилось.

Недавно столкнулся с похожей ситуацией, и вот что помогло:

Между прочим, если вас интересует tars-rubber.ru, посмотрите сюда.

Вот, делюсь ссылкой:

https://tars-rubber.ru

Рад был поделиться информацией.

Вот отличный материал, который проливает свет на ситуацию:

Для тех, кто ищет информацию по теме “parkpodarkov.ru”, нашел много полезного.

Вот, можете почитать:

https://parkpodarkov.ru

Что думаете по этому поводу?

Кстати, вот что я думаю по этому поводу:

По теме “avelonbeta.ru”, есть отличная статья.

Ссылка ниже:

https://avelonbeta.ru

Надеюсь, смог помочь.

Полагаю, это снимет все дальнейшие вопросы:

Особенно понравился раздел про yogapulse.ru.

Вот, можете почитать:

https://yogapulse.ru

Спасибо, что дочитали до конца.

Это именно то, что я искал!

Для тех, кто ищет информацию по теме “clasifieds.ru”, есть отличная статья.

Вот, делюсь ссылкой:

https://clasifieds.ru

Что думаете по этому поводу?

Чтобы было понятнее, о чем речь:

Между прочим, если вас интересует rustrail.ru, загляните сюда.

Ссылка ниже:

https://rustrail.ru

Жду конструктивной критики.

Новости Украины https://gromrady.org.ua в реальном времени. Экономика, политика, общество, культура, происшествия и спорт. Всё самое важное и интересное на одном портале.

Современный автопортал https://automobile.kyiv.ua свежие новости, сравнительные обзоры, тесты, автострахование и обслуживание. Полезная информация для водителей и покупателей.

Строительный сайт https://vitamax.dp.ua с полезными материалами о ремонте, дизайне и современных технологиях. Обзоры стройматериалов, инструкции по монтажу, проекты домов и советы экспертов.

Как вариант, можно рассмотреть следующее:

По теме “eqa.ru”, нашел много полезного.

Смотрите сами:

https://eqa.ru

Всем добра!

Очень рекомендую к прочтению:

Зацепил раздел про obender.ru.

Смотрите сами:

https://obender.ru

Буду признателен за ваши отзывы.

Кстати, вот что я думаю по этому поводу:

По теме “raregreen.ru”, нашел много полезного.

Вот, делюсь ссылкой:

https://raregreen.ru

Буду следить за обсуждением.

Недавно столкнулся с похожей ситуацией, и вот что помогло:

Хочу выделить раздел про obender.ru.

Смотрите сами:

https://obender.ru

Успехов в решении вашего вопроса!

Как вариант, можно рассмотреть следующее:

Зацепил материал про yogapulse.ru.

Вот, делюсь ссылкой:

https://yogapulse.ru

Жду ваших комментариев.

Сайт о строительстве https://stinol.com.ua практические рекомендации, проекты, обзоры инструментов и материалов. Советы экспертов, новости отрасли и новые технологии.

Строительный журнал https://mts-slil.info с актуальными новостями отрасли, обзорами материалов, инструкциями по ремонту и строительству. Полезные советы для специалистов и частных застройщиков.

Онлайн сайт https://purr.org.ua о строительстве и ремонте: полезные статьи, инструкции, обзоры технологий, дизайн-идеи и архитектурные решения для вашего дома.

Онлайн туристический https://azst.com.ua портал: всё о путешествиях, туризме и отдыхе. Маршруты, отели, лайфхаки для туристов, актуальные цены и интересные статьи о странах.

Онлайн новостной https://antifa-action.org.ua портал с круглосуточным обновлением. Свежие новости, репортажи и обзоры. Важные события страны и мира, мнения экспертов и актуальная аналитика.

Новости Украины https://uamc.com.ua новости дня, аналитика, события регионов и мира. Обзоры, интервью, мнения экспертов. Быстро, достоверно и удобно для читателей.

Новостной портал https://prp.org.ua с актуальной информацией о событиях в России и мире. Политика, экономика, культура, спорт и технологии. Новости 24/7, аналитика и комментарии экспертов.

Строительный портал https://suli-company.org.ua с актуальными новостями, обзорами материалов, проектами и инструкциями. Всё о ремонте, строительстве и дизайне.

freight company new york shipping company new york city

Портал про авто https://prestige-avto.com.ua обзоры новых и подержанных машин, тест-драйвы, рынок автомобилей, страхование и обслуживание.

Онлайн автомобильный https://avtonews.kyiv.ua портал: свежие автоновости, сравнительные тесты, статьи о ремонте и тюнинге. Обзоры новых и подержанных машин, цены и советы экспертов.

Современный автомобильный https://mallex.info портал: автообзоры, тесты, ремонт и обслуживание, страхование и рынок. Всё, что нужно водителям и любителям автомобилей.

Строительный сайт https://novostroi.in.ua с полезными статьями о ремонте, отделке и дизайне. Обзоры стройматериалов, проекты домов, инструкции и советы экспертов для профессионалов и новичков.

Автомобильный портал https://autonovosti.kyiv.ua новости автопрома, обзоры моделей, тест-драйвы и советы по эксплуатации. Всё для автолюбителей: от выбора авто до обслуживания и ремонта.

Портал для родителей https://detiwki.com.ua и детей — всё для счастливой семьи. Воспитание, образование, здоровье, отдых и полезные материалы для мам, пап и малышей.

Универсальный сайт https://virginvirtual.net для женщин — секреты красоты, тренды моды, советы по отношениям и карьере, рецепты и стиль жизни.

Сайт для женщин https://stylewoman.kyiv.ua с интересными статьями о моде, красоте, семье и здоровье. Идеи для кулинарии, путешествий и вдохновения.

Журнал садовода https://mts-agro.com.ua полезные советы по уходу за садом и огородом. Сезонные работы, выращивание овощей, фруктов и цветов, современные технологии и секреты урожая.

Сайт для женщин https://gratransymas.com о красоте, моде, здоровье и стиле жизни. Полезные советы, рецепты, тренды, отношения и карьера.

Студия дизайна https://lbook.com.ua интерьера и архитектуры. Создаём стильные проекты квартир, домов и офисов. Индивидуальный подход, современные решения и полный контроль реализации.

Сайт обо всём https://vybir.kiev.ua энциклопедия для повседневной жизни. Красота, здоровье, дом, путешествия, карьера, семья и полезные советы для всех.

Интересный сайт https://whoiswho.com.ua обо всём: статьи, лайфхаки, обзоры и идеи на самые разные темы. Всё, что нужно для вдохновения и развития, в одном месте.

Онлайн портал https://esi.com.ua про ремонт: идеи для интерьера, подбор материалов, практические рекомендации и пошаговые инструкции для самостоятельных работ.

Репортажи в больших https://infotolium.com фотографиях: самые обсуждаемые события, уникальные кадры и впечатляющие истории. Новости и жизнь в формате визуального рассказа.

Сайт про автомобили https://black-star.com.ua новинки рынка, цены, тест-драйвы и обзоры. Советы экспертов по выбору и уходу за машиной, тюнинг и автоуслуги.

Автомобильный онлайн-журнал https://allauto.kyiv.ua свежие новости автопрома, тест-драйвы, обзоры новых моделей, советы по эксплуатации и ремонту. Всё для водителей и автолюбителей.

Онлайн-журнал https://autoiceny.com.ua для автолюбителей: автомобили, новости индустрии, тест-драйвы, тюнинг и советы по обслуживанию.

Royal portraits http://www.turnyouroyal.com from photos – turn yourself or your loved ones into a king, queen or aristocrat. Author’s work of artists, luxurious style and premium quality of printing.

Сайт про авто https://autoinfo.kyiv.ua свежие новости автопрома, обзоры моделей, тест-драйвы и советы по эксплуатации. Всё о машинах для водителей и автолюбителей.

Информационный портал https://reklama-region.com про ремонт: ремонт квартир, домов, офисов. Практические рекомендации, современные решения и обзоры стройматериалов.

Авто-журнал https://bestauto.kyiv.ua источник информации для автолюбителей. Новинки рынка, сравнения моделей, советы по ремонту и уходу, интересные материалы о мире автомобилей.

Новостной портал https://gau.org.ua круглосуточные новости, комментарии экспертов, события регионов и мира. Политика, бизнес, культура и общество.

Онлайн авто-журнал https://mirauto.kyiv.ua с актуальными новостями, аналитикой и обзорами. Тесты автомобилей, тюнинг, технологии и советы по эксплуатации.

Авто портал https://avtomobilist.kyiv.ua всё об автомобилях: новые модели, цены, рынок подержанных авто, тюнинг и автотехнологии. Полезные материалы для автовладельцев.

Мужской портал https://hooligans.org.ua новости, лайфхаки, обзоры техники, спорт, здоровье и авто. Советы для уверенной и гармоничной жизни.

Как раз то, что нужно для решения этого вопроса:

Для тех, кто ищет информацию по теме “detoxa.ru”, есть отличная статья.

Вот, можете почитать:

https://detoxa.ru

Рад был поделиться информацией.

Это именно то, что я искал!

Особенно понравился материал про fixora.ru.

Вот, можете почитать:

https://fixora.ru

Всем добра!

Портал о ремонте https://dki.org.ua и строительстве: от отделки квартиры до возведения загородного дома. Подробные статьи, рекомендации экспертов и идеи для обустройства жилья.

Портал о стройке https://sushico.com.ua и ремонте. Новости рынка, современные технологии, подборка идей для интерьера и экстерьера. Всё, что нужно для дома и дачи.

Онлайн сайт https://mramor.net.ua о строительстве и ремонте. Всё о возведении домов, ремонте квартир, отделке и обустройстве жилья. Обзоры материалов, советы экспертов и свежие идеи.

Всё о стройке https://aziatransbud.com.ua и ремонте в одном месте: дизайн, архитектура, выбор стройматериалов, инструкции по монтажу, лайфхаки и полезные рекомендации для новичков и мастеров.

Сайт о строительстве https://juglans.com.ua и ремонте — ваш помощник в выборе материалов, инструментов и технологий. Всё о ремонте квартир, строительстве домов и дизайне интерьеров.

Онлайн журнал https://vitamax.dp.ua о строительстве: проекты домов, ремонт квартир, выбор стройматериалов, дизайн и интерьер. Советы экспертов и свежие идеи для комфортной жизни.

Портал про строительство https://texha.com.ua новости рынка, обзоры технологий, инструкции и идеи для ремонта. Материалы для застройщиков, мастеров и тех, кто делает своими руками.

Новости Украины https://gromrady.org.ua онлайн: политика, экономика, спорт, культура и события регионов. Оперативные материалы, аналитика и комментарии экспертов круглосуточно.

audio processing mp3 editing

Prodaja placevi zabljak: stanovi, vile, zemljisne parcele. Izbor smestaja za odmor, preseljenje i investicije. Saveti strucnjaka i aktuelne ponude na trzistu.

Авто портал https://road.kyiv.ua с актуальной информацией: новинки рынка, цены, обзоры, страхование и тюнинг. Полезные статьи и аналитика для автомобилистов.

Портал про авто https://automobile.kyiv.ua свежие новости автопрома, тест-драйвы, обзоры моделей и советы по ремонту. Всё о машинах для водителей и автолюбителей.

Давно слежу за этой темой, хочу поделиться находкой:

Кстати, если вас интересует fk-almazalrosa.ru, посмотрите сюда.

Ссылка ниже:

https://fk-almazalrosa.ru

Может, у кого-то есть другой опыт?

Нужна топливная карта? https://avtobas40.ru. Экономия до 15%, автоматическая отчётность, удобные безналичные расчёты и контроль автопарка онлайн.

Besoin d’un bien immobilier? immobilier au Montenegro: appartements en bord de mer, maisons a la montagne, villas et appartements. Catalogue de biens, prix actuels et conseils d’experts en investissement.

Хотите оформить карту на топливо? https://ktz59.ru. Контроль за каждой транзакцией, отчёты для бухгалтерии, гибкие лимиты и бонусные программы.

Возможно, это будет полезно участникам обсуждения:

Между прочим, если вас интересует classifields.ru, загляните сюда.

Ссылка ниже:

https://classifields.ru

Дайте знать, если найдете что-то еще.

Фильмы и сериалы лучший сайт для просмотра фильмов онлайн кинобэй Онлайн-кинотеатр без регистрации и смс: тысячи фильмов и сериалов бесплатно.

Jak samodzielnie zdjac https://telegra.ph/Jak-samodzielnie-zdj%C4%85%C4%87-sufit-napinany-instrukcja-krok-po-kroku-bez-haka-z-wkr%C4%99tem-i-trikami-monta%C5%BCyst%C3%B3w-08-07 sufit napinany: instrukcje krok po kroku, narzedzia, porady ekspertow. Dowiedz sie, jak zdemontowac plotno bez uszkodzen i przygotowac pomieszczenie do montazu nowej okladziny.

Очень рекомендую к прочтению:

Зацепил материал про m-admin.ru.

Смотрите сами:

https://m-admin.ru

Поделитесь своими мыслями в комментариях.

Это именно то, что я искал!

Кстати, если вас интересует localflavors.ru, посмотрите сюда.

Ссылка ниже:

https://localflavors.ru

Если есть вопросы, задавайте.

салон красоты приморский район http://beauty-salon-spb.ru

Вот тут есть все ответы на ваши вопросы:

Зацепил раздел про classifields.ru.

Вот, делюсь ссылкой:

https://classifields.ru

Надеюсь, у вас все получится.

оценка имущества оценить рыночную стоимость

устройство плоской крыши https://montazh-ploskoj-krovli.ru

Создать документы онлайн конструктор договора скачать: создайте договор, заявление или акт за 5 минут. Простая форма, готовые шаблоны, юридическая точность и возможность скачать в нужном формате.

Вот, что говорят эксперты по этому поводу:

Между прочим, если вас интересует m-admin.ru, загляните сюда.

Смотрите сами:

https://m-admin.ru

Пишите, что у вас получилось.

Чтобы разобраться в вопросе, рекомендую ознакомиться:

По теме “classifields.ru”, нашел много полезного.

Вот, делюсь ссылкой:

https://classifields.ru

Если есть вопросы, задавайте.

Полностью поддерживаю, и вот еще одно подтверждение:

Зацепил материал про obender.ru.

Смотрите сами:

https://obender.ru

Может, у кого-то есть другой опыт?

Вот отличный материал, который проливает свет на ситуацию:

Хочу выделить материал про eqa.ru.

Вот, можете почитать:

https://eqa.ru

Надеюсь, смог помочь.

Авто помощь 24/7 автопомощь на дороге спб: устранение поломок, подвоз топлива, прикуривание аккумулятора, замена колеса и эвакуация автомобиля.

Вот здесь подробно расписано, как это сделать:

Хочу выделить материал про fixora.ru.

Ссылка ниже:

https://fixora.ru

Обращайтесь, если что.

Срочно нужны цветы Минск Свежие букеты, праздничные композиции и эксклюзивные флористические решения. Онлайн-заказ и быстрая доставка по городу.

Профессиональные https://812detailing.com/: полировка кузова, химчистка салона, восстановление пластика и защита керамикой. Вернём автомобилю блеск и надёжную защиту.

Нужен массаж? https://doctu.ru – профессиональные мастера, широкий выбор техник: классический, оздоровительный, лимфодренажный, детский. Доступные цены и уютная атмосфера.

Обучающие курсы онлайн складчина новые навыки для работы и жизни. IT, дизайн, менеджмент, языки, маркетинг. Гибкий график, практика и сертификаты по итогам.

vps hosting vps hosting

Очень рекомендую к прочтению:

Кстати, если вас интересует lingomap.ru, посмотрите сюда.

Вот, можете почитать:

https://lingomap.ru

Может, у кого-то есть другой опыт?

косметологический столик стул косметолога со спинкой купить

Хотите заказать интро для диджея? Индивидуальная разработка музыкальных заставок для рекламы, подкастов и презентаций. Качественный звук и креатив для запоминающегося бренда.

Чтобы не быть голословным, прикрепляю ссылку:

Для тех, кто ищет информацию по теме “detoxa.ru”, нашел много полезного.

Смотрите сами:

https://detoxa.ru

Поделитесь своими мыслями в комментариях.

Наркологические услуги: наркологическая клиника стационар нижний новгород, кодирование, детоксикация, снятие ломки, помощь при алкоголизме и наркомании. Круглосуточная поддержка и анонимность.

Всем привет, нашел интересную информацию по теме:

Между прочим, если вас интересует fk-almazalrosa.ru, загляните сюда.

Смотрите сами:

https://fk-almazalrosa.ru

Если у вас есть что добавить, не стесняйтесь.

Puzzle Man Pro https://apps.apple.com/ar/app/puzzle-man-pro/id455696756 exciting puzzles for iOS. Collect classic pictures or create puzzles from your own photos. Different difficulty levels, user-friendly interface and saving progress.

Свежее и интересное: http://remsanteh.borda.ru/?1-1-0-00003083-000-0-0-1754909107

Стройкаталог https://stroycata1og.ru проекты коттеджей, дома любой площади, каталог стройматериалов. Комплексные услуги от проектирования до сдачи объекта с гарантией качества.

бетон цена за м3 с доставкой бетон

Block Puzzle Wood Classic https://apps.apple.com/fo/app/block-puzzle-wood-classic/id1615792350 is a puzzle game where you need to correctly place wooden blocks. Simple controls, beautiful visuals and addictive gameplay for all ages.

Handmade porcelain flowers Ideal for home, office decor or original gift. Natural beauty and durability.

Бетон в Воронеже https://stk-vrn.ru продажа и доставка. Все марки для фундаментов, дорожных работ и строительства под ключ. Надёжный производитель и лучшие цены.

нтернет-магазин сантехники https://vodomirural.ru ванны, смесители, унитазы, раковины и душевые кабины. Большой выбор, доступные цены, доставка и гарантия качества от производителей.

Рейтинг хостингов топ хостингов для сайта подбор сервисов для сайтов и интернет-магазинов. Сравнение тарифов, гарантия стабильности и рекомендации по выбору.

Рестораны Хамовников https://restoran-khamovniki.ru топ заведений для встреч, романтических ужинов и семейных обедов. Авторская кухня, стильный интерьер, удобное расположение и достойный сервис.

Лучшие рестораны https://hamovniki-restoran.ru Хамовников для ценителей гастрономии. Подборка заведений с изысканной кухней, качественным сервисом и атмосферой для отдыха и деловых встреч.

Курсы по плазмотерапии плазмолифтинг обучение освоение методик, современные протоколы, практическая отработка. Обучение для специалистов с выдачей сертификата и повышением квалификации.

Профессиональное обучение обучение prp в косметологии: подробная программа, практические навыки, сертификация. Освойте эффективные методики для применения в медицине и косметологии.

Детская школа искусств https://elegy-school.ru обучение музыке, танцам, изобразительному и театральному искусству. Творческие программы для детей, концерты, конкурсы и развитие талантов.

Авторские курсы по REVIT https://dashclass.ru обучение созданию интерьеров и архитектурных проектов. Практика, реальные кейсы, индивидуальный подход и профессиональные навыки для работы в проектировании.

Первая помощь детям https://firstaidkids.ru правила оказания при травмах, ожогах, удушье и других ситуациях. Пошаговые инструкции, советы врачей и полезная информация для родителей.

Студия иностранных языков https://whats-up-studiya-inostrannyh-yazykov.ru обучение английскому, немецкому, французскому и другим языкам. Индивидуальные и групповые занятия, современные методики и опытные преподаватели.

Срочный вызов сантехника https://master-expert.com в Москве на дом. Услуги сантехника: прочистка засоров, ремонт смесителей, установка приборов учета. Работаем 24/7. Недорого и с гарантией. Подробнее на сайте

Детский сад № 55 https://detsadik55.ru забота, развитие и обучение детей. Современные программы, квалифицированные воспитатели, уютные группы, безопасная среда и внимание к каждому ребёнку.

Промышленная безопасность https://аттестация-промбезопасность.рф курсы и обучение под ключ. Подготовка к проверке Ростехнадзора, повышение квалификации и сертификация специалистов предприятий.

Автомобили на заказ https://avto-iz-kitaya1.ru поиск, проверка, покупка и доставка. Китай и Корея. Индивидуальный подбор под бюджет и пожелания клиента, полное сопровождение сделки.

Авто из Китая https://avto-iz-kitaya2.ru на заказ под ключ: подбор, проверка, доставка и растаможка. Новые и подержанные автомобили, выгодные цены и полное сопровождение сделки.

Авто из Китая под заказ https://dostavka-avto-china.ru кроссоверы, седаны, электромобили и премиальные модели. Индивидуальный подбор, проверка, сопровождение сделки и доставка в ваш город.

Автомобили из Китая на заказ https://avto-iz-kitaya2.ru подбор, покупка и доставка. Полный цикл услуг: диагностика, растаможка, постановка на учёт и гарантия качества.

PuzzleFree online puzzles https://en.wikipedia.org/wiki/file:1980s_unicef_jigsaw_puzzle.jpg hundreds of pictures to assemble, different difficulty levels and user-friendly interface. Enjoy the process, train your memory and attention for free.

Заказать авто из Китая https://dostavka-avto-china2.ru новые автомобили с гарантией, выгодные цены и проверенные поставщики. Доставка, таможня и оформление всех документов под ключ.

Авто на заказ https://dostavka-avto-russia.ru поиск, диагностика и сопровождение сделки. Машины из Европы, Кореи, Китая и США. Доставка, растаможка и постановка на учёт.

Автомобили на заказ https://dostavka-avto-russia5.ru профессиональный подбор, юридическая проверка, доставка и растаможка. Индивидуальные решения для каждого клиента.

Хотите заказать авто https://prignat-avto5.ru Мы подберём оптимальный вариант, проверим машину по базам, организуем доставку и таможенное оформление. Выгодные цены и прозрачные условия.

Машины на заказ https://prignat-avto7.ru поиск, диагностика и доставка автомобилей. Индивидуальный подбор, проверенные поставщики и прозрачные условия покупки.

Машины на заказ https://prignat-mashinu5.ru поиск, диагностика и доставка автомобилей. Индивидуальный подбор, проверенные поставщики и прозрачные условия покупки.

Автомобили на заказ https://prignat-mashinu7.ru подбор, проверка, доставка и оформление документов. Машины любых марок и комплектаций с гарантией качества и выгодной ценой.

Наружная реклама https://pioner-reklama.ru и вывески под ключ: дизайн, производство и монтаж. Световые короба, объёмные буквы, баннеры и витрины. Индивидуальные решения для бизнеса любого масштаба.

Ремонт квартир https://remontkomand.kz и домов под ключ: дизайн-проект, отделка, инженерные работы. Работаем по договору, фиксированные сроки и цены. Гарантия качества и полный контроль этапов.

SEO-продвижение сайтов https://raskrutka-sajtov-bystro77.ru в Москве: вывод в ТОП поисковиков, рост трафика и заявок. Полный комплекс — аудит, семантика, оптимизация, ссылки. Эффективное продвижение под ключ.

Планируете ремонт https://remontkomand.kz в Алматы и боитесь скрытых платежей? Опубликовали полный и честный прайс-лист! Узнайте точные расценки на все виды работ — от демонтажа до чистовой отделки. Посчитайте стоимость своего ремонта заранее и убедитесь в нашей прозрачности. Никаких «сюрпризов» в итоговой смете!

Онлайн-курсы курсы по заработку онлайн. Изучайте языки, IT, дизайн, маркетинг и другие направления. Удобный формат, доступ к материалам 24/7

Строительство домов https://stroycata1og.ru и коттеджей под ключ. Готовые проекты, индивидуальные решения, качественные материалы и полный цикл работ — от фундамента до отделки.

Журнал о саде https://nasha-gryadka.ru и огороде онлайн — статьи о выращивании овощей, цветов и фруктов. Советы по уходу, борьбе с вредителями, подбору семян и организации участка.

Нужна качественная регулировка окон пвх? Специалисты настроят створки, фурнитуру и уплотнители. Устранение продувания, перекоса и тяжёлого открывания с гарантией качества.

Tree removal and care https://www.highqualitytreeservice.com/ pruning, crown shaping, treatment, removal and felling of hazardous trees. Experienced specialists and modern equipment. Safe, professional and with a guarantee of results.

Нужен клининг? список клининговых компаний москвы. Лучшие сервисы уборки квартир, домов и офисов. Сравнение услуг, цен и отзывов, чтобы выбрать надежного подрядчика.

Стоматологическая клиника https://almazdental35.ru с индивидуальным подходом. Безболезненное лечение, эстетическая стоматология, имплантация и профессиональная гигиена полости рта.

У детей пробелмы с зубами? консультация детского ортодонта — лечение и профилактика зубов у детей. Безопасные методы, комфортная атмосфера и заботливые врачи для маленьких пациентов.

Смотрите сериалы Лучшие сериалы онлайн: https://www.justmedia.ru/news/russiaandworld/serialy-onlayn-kak-vybrat-i-gde-smotret онлайн в хорошем качестве. Новинки, классика и популярные проекты в удобном формате. Бесплатный просмотр без скачивания и доступ 24/7.

Нужна контекстная реклама? контекстная реклама для стоматологии под ключ. Настройка в Яндекс.Директ и Google Ads, оптимизация объявлений и контроль заявок.

Комплексные IT-решения https://eclat.moscow для бизнеса: разработка, внедрение, сопровождение и поддержка. Надежные технологии для автоматизации и цифровой трансформации.

Play puzzles online https://x.com/puzzlefree_game free and without restrictions. A huge selection of pictures, simple controls and the ability to develop attention, memory and thinking. A great way to relax and spend time usefully.

swot анализ проблемы swot анализа рисков

swot анализ суть swot анализ вопросы

Looking for second-hand? thrifting near me We have collected the best stores with clothes, shoes and accessories. Large selection, unique finds, brands at low prices. Convenient catalog and up-to-date contacts.

В современном мире юридические консультации играют важную роль.. Каждый может столкнуться с правовыми вопросами, которые требуют профессионального вмешательства..

На платформе konsultaciya-advokata11.ru можно найти множество юридических консультаций. На нашем сайте доступны услуги по самым разным направлениям права. Получите помощь квалифицированного юриста на вопрос юристу онлайн бесплатно круглосуточно.

Профессиональные адвокаты готовы помочь вам.. Мы стремимся предоставить клиентам только лучшие юридические решения..

Обратитесь к нам, и вы не пожалеете о своем выборе.. Мы гарантируем профессионализм и индивидуальный подход к каждому клиенту..

С получением профессиональной помощи в решении юридических вопросов вы можете обратиться к налоговый консультант онлайн, где можно получить юридическую консультацию круглосуточно и бесплатно.

Ресурс ‘konsultaciya-advokata81.ru’ предоставляет разнообразные правовые консультации.

Looking for second-hand? thrift store store near me We have collected the best stores with clothes, shoes and accessories. Large selection, unique finds, brands at low prices. Convenient catalog and up-to-date contacts.

ЭВЛО https://evlo-phlebology.ru эндовазальная лазерная коагуляция вен, наряду со склеротерапией является эффективным методом лечения варикозного расширения вен на ногах.

Услуги госпитализации https://hospitall.ru экстренная помощь при угрожающих состояниях и плановое лечение с заранее согласованной программой. Подбор клиники, транспортировка и поддержка пациента на всех этапах.

карго доставка из китая карго из китая в россию

купить продукты с фермы фермерские продукты недорого в москве

Онлайн-библиотека Казахстана https://mylibrary.kz книги, статьи, диссертации и редкие издания в цифровом формате. Удобный каталог, быстрый поиск и круглосуточный доступ для всех пользователей.

Эндовазальная лазерная коагуляция https://evlo-phlebology.ru эффективный метод лечения варикоза. Амбулаторная процедура занимает до 40 минут, не требует госпитализации и обеспечивает быстрый косметический и медицинский результат.

Сюрвей грузов сюрвей контроль качества и количества, проверка условий перевозки, составление отчётов. Опытные эксперты обеспечивают объективную оценку для компаний и страховых организаций.

Надежная доставка из китая в Россию: от документов до контейнеров. Выбираем оптимальный маршрут, оформляем таможню, страхуем грузы. Контроль сроков и сохранность на каждом этапе.

создание корпоративного сайта https://art-made.ru/

Надежная доставка грузов из китая: от небольших партий до контейнеров. Авиа, морем, авто и железной дорогой. Оформление, страхование и логистика в кратчайшие сроки.

Нужен автобусный билет? билеты на автобус онлайн просто и удобно. Поиск рейсов, сравнение цен, выбор мест и моментальная оплата. Актуальное расписание, надежные перевозчики и выгодные тарифы каждый день.

Качественный ремонт квартир https://expertremonta.kz от Компании «Эксперт ремонта» это качественный ремонт квартир под ключ в Алматы. Выбирайте Эксперт Ремонта — тут бесплатный выезд замерщика, официальные документы, гарантия документально, ремонт квартир без предоплаты.

купить дт с доставкой доставка зимнего дизельного топлива

куплю растительный грунт торф низинный

Получите бесплатную юридическую консультацию онлайн, чтобы оперативно решить все ваши юридические вопросы!

Мы понимаем, что разобраться закон может быть трудно.

Обратитесь за помощью к профессионалам на бесплатная консультация юриста, и получите квалифицированное решение своих вопросов.

yuridicheskaya-konsultaciya34.ru предлагает профессиональные юридические услуги, направленные на решение различных правовых вопросов. Наша команда готова помочь вам в самых сложных ситуациях. Мы понимаем, что правовые проблемы могут быть стрессовыми, мы предлагаем индивидуальный подход к каждому клиенту.

В нашем арсенале широкий спектр услуг, включая консультации по гражданским и уголовным делам. Вы можете обратиться к нам по вопросам, связанным с трудовым правом, семейными делами и другими юридическими аспектами. Мы понимаем, что каждая ситуация требует индивидуального подхода, и готовы предложить оптимальное решение.

Мы гордимся нашей репутацией как надежный партнер в сфере юриспруденции. Клиенты выбирают нас за профессионализм за высокое качество обслуживания и результативность. Все наши юристы имеет опыт работы в различных областях права и готов поддержать вас в любое время.

Не ждите, пока ситуация усугубится , чтобы получить квалифицированную юридическую помощь. Наша команда будет рада проконсультировать вас . Воспользуйтесь нашими услугами на yuridicheskaya-konsultaciya34.ru.

Mochten Sie ein Montenegro haus kaufen kaufen? Tolle Angebote am Meer und in den Bergen. Gro?e Auswahl an Immobilien, Unterstutzung bei der Immobilienauswahl, Transaktionsunterstutzung und Registrierung. Leben Sie in einem Land mit mildem Klima und wunderschoner Natur.

Новые актуальные промокод iherb приложение для выгодных покупок! Скидки на витамины, БАДы, косметику и товары для здоровья. Экономьте до 30% на заказах, используйте проверенные купоны и наслаждайтесь выгодным шопингом.

best articles on the net: https://dnscompetition.in/articles/how-dns-interacts-with-cdn-and-accelerates-content-delivery/

перевозки из китая транспортная компания из китая в россию

шпонированные панели дсп шпонирование фанеры на заказ

геодезия цена геодезические изыскания москва цена

геотекстиль 200 москва геотекстиль сибур

Включение в реестр Минпромторга https://minprom-info.ru официальный путь для подтверждения отечественного производства. Подготовка и подача документов, юридическое сопровождение и консультации для производителей.

Занятия по самообороне https://safety-skills.ru практические навыки защиты в реальных ситуациях, развитие силы и выносливости. Профессиональные тренеры помогут освоить приемы борьбы, удары и тактику безопасности.

Платформа онлайн-обучения https://craftsmm.ru курсы по маркетингу, продажам и рекламе для новичков и профессионалов. Освойте современные инструменты продвижения, увеличьте продажи и развивайте карьеру в удобном формате.

Написание дипломов на заказ https://vasdiplom.ru помощь студентам в подготовке итоговых работ. Авторские тексты, проверка на уникальность и полное соответствие стандартам учебных заведений.

Обучение и семинары https://uofs-beslan.ru для профессионалов: современные программы, практические кейсы и опыт экспертов. Развивайте навыки, повышайте квалификацию и получайте новые возможности для карьерного роста.

Академия парикмахерского искусства https://charm-academy.ru обучение от ведущих мастеров. Современные техники стрижек, окрашивания и укладок. Курсы для начинающих и профессионалов с практикой и дипломом по окончании.

Школа видеорекламы https://tatyanamostseeva.ru обучение созданию креативных роликов для бизнеса и брендов. Практические занятия, работа с современными инструментами и поддержка экспертов. Освойте профессию в сфере digital.

Лицей взаимного обучения https://talgenisty.ru уникальная среда для детей и взрослых. Совместные уроки, обмен опытом, мастер-классы и творческие проекты. Образование, основанное на поддержке и сотрудничестве.

Нужен автобусный билет? probilets.com удобный сервис поиска и бронирования. Широкий выбор направлений, надежные перевозчики, доступные цены и моментальная отправка электронных билетов на почту.

Авто портал https://diesel.kyiv.ua все о мире автомобилей: новости, обзоры моделей, тест-драйвы, советы по выбору и уходу за авто. Каталог машин, актуальные цены, автоуслуги и полезная информация для автовладельцев.

Автомобильный портал https://auto-club.pl.ua онлайн-площадка для автолюбителей. Подробные обзоры машин, тест-драйвы, свежие новости, советы по ремонту и обслуживанию. Удобный поиск и актуальные материалы.

Все для автомобилистов https://k-moto.com.ua на авто портале: новости, обзоры, статьи, каталоги и цены на автомобили. Экспертные мнения, тест-драйвы и практические советы по эксплуатации авто.

Нужна виза? https://delovaya-viza.ru Консультации, подготовка документов, сопровождение на всех этапах. Визы в Европу, США, Азию и другие страны. Доступные цены и надежная поддержка.

Онлайн женский портал https://elegance.kyiv.ua актуальные советы по красоте, стилю, кулинарии и семейной жизни. Разделы о здоровье, карьере и саморазвитии. Интересные статьи и общение с единомышленницами.

Женский портал https://beautyadvice.kyiv.ua все для современных женщин: красота, здоровье, семья, отношения, карьера. Полезные статьи, советы экспертов, лайфхаки и вдохновение каждый день. Онлайн-сообщество для общения и развития.

Портал для женщин https://fashionadvice.kyiv.ua сайт для девушек и женщин, которые ценят красоту, уют и гармонию. Советы по стилю, отношениям, материнству и здоровью. Читайте статьи, делитесь опытом и вдохновляйтесь новыми идеями.

Получите бесплатную консультацию юриста по телефону на сайте адвокат бесплатно.

Раздел 1: Введение

Адвокат поможет вам понять, какие бумаги нужны для вашего дела.

На сайте konsultaciya-advokata51.ru вы можете найти множество полезных услуг. Юридическая консультация – это важный шаг для многих людей. Мы обеспечим вас экспертными консультациями.

Получите бесплатную юридическую консультацию круглосуточно на бесплатные консультации юриста онлайн.

На сайте konsaltaciya-advokata51.ru вы найдете множество информации о правовых услугах.

Первое, что стоит учитывать – это квалификация адвокатов. Наши юристы обладают необходимыми знаниями и опытом. Мы стремимся обеспечить высокий уровень обслуживания.

Мы предлагаем широкий спектр услуг, доступных для разных категорий граждан. Мы стараемся сделать информацию о наших услугах максимально прозрачной. Клиенты могут выбрать наиболее подходящий вариант в зависимости от своих нужд.

Наши адвокаты готовы предоставить юридическую помощь в режиме онлайн. Это особенно удобно для тех, кто ценит своё время. Вы можете задать свои вопросы в любое время.

Авто портал https://avtoshans.in.ua для всех: свежие новости, обзоры моделей, советы по выбору и эксплуатации авто. Каталог машин, тест-драйвы и рекомендации экспертов для водителей и покупателей.

Портал про автомобили https://myauto.kyiv.ua онлайн-ресурс для автолюбителей. Обзоры, статьи, тест-драйвы, цены и полезные советы по ремонту и уходу за машиной. Всё о мире авто в одном месте.

Автомобильные новости https://reuth911.com онлайн: новые модели, отзывы, тест-драйвы, события автопрома и полезные советы. Узнайте первыми о главных новинках и трендах автомобильного мира.

Свежие новости авто https://orion-auto.com.ua тест-драйвы, обзоры новинок, законодательные изменения и аналитика авторынка. Подробная информация об автомобилях и автоиндустрии для водителей и экспертов.

Автомобильный сайтhttps://setbook.com.ua свежие новости, обзоры моделей, тест-драйвы и советы экспертов. Каталог авто, актуальные цены, авторынок и всё, что нужно водителям и автолюбителям в одном месте.

Онлайн-сайт для женщин https://musicbit.com.ua стиль, уход за собой, психология, семья, карьера и хобби. Интересные статьи, тесты и форум для общения. Пространство для вдохновения и развития.

Онлайн-журнал для женщин https://fines.com.ua стиль, уход за собой, психология, рецепты, материнство и карьера. Актуальные материалы, тренды и экспертные рекомендации каждый день.

Женский сайт о жизни https://prettywoman.kyiv.ua секреты красоты, мода, здоровье, рецепты и отношения. Интересные статьи, советы и лайфхаки. Всё, что нужно, чтобы чувствовать себя уверенно и счастливо.

https://193fz.ru/

Онлайн-сайт про автомобили https://tvregion.com.ua свежие новости, аналитика рынка, обзоры и сравнения машин. Советы по обслуживанию и выбору авто. Всё для водителей и автолюбителей в одном месте.

Женский онлайн-журнал https://feminine.kyiv.ua мода, красота, здоровье, отношения и семья. Полезные советы, вдохновляющие статьи, лайфхаки для дома и карьеры. Всё самое интересное для современных женщин.

Автомобильный портал https://troeshka.com.ua онлайн-ресурс для автовладельцев. Каталог машин, тест-драйвы, аналитика авторынка и советы специалистов. Будьте в курсе новинок и технологий автоиндустрии.

Сайт для женщин https://lolitaquieretemucho.com мода, красота, здоровье, отношения, семья и карьера. Полезные советы, статьи, рецепты и лайфхаки. Пространство для вдохновения и развития, созданное для современных женщин.

https://peterburg2.ru/

Сайт для женщин https://femaleguide.kyiv.ua гармония стиля и жизни. Уход за собой, рецепты, дом, отношения, карьера и путешествия. Читайте статьи, делитесь опытом и вдохновляйтесь новыми идеями.

Автомобильный новостной портал https://tuning-kh.com.ua всё об авто в одном месте: новости, цены, обзоры, тест-драйвы, авторынок. Советы экспертов и полезные материалы для водителей и тех, кто планирует купить машину.

Сайт про машины https://tvk-avto.com.ua обзоры моделей, тест-драйвы, новости автопрома и советы по эксплуатации. Полезные статьи о выборе авто, уходе, ремонте и актуальные материалы для автовладельцев.

Женский онлайн портал https://femalesecret.kyiv.ua онлайн-ресурс для девушек и женщин. Мода, красота, здоровье, семья и материнство. Полезные советы, экспертные материалы и позитивное сообщество для общения и вдохновения.

Онлайн-сайт для женщин https://mirlady.kyiv.ua красота, стиль, здоровье, дом и семья. Практичные рекомендации, модные идеи, вдохновение и поддержка. Лучший контент для девушек и женщин любого возраста.

Сайт для женщин https://amideya.com.ua портал о красоте, стиле, здоровье, семье и саморазвитии. Ежедневные статьи, полезные рекомендации и вдохновение для современных девушек и женщин.

Женский сайт https://lubimoy.com.ua стиль, уход за собой, психология, материнство, работа и хобби. Актуальные статьи, тренды и экспертные советы. Всё самое важное для гармоничной жизни и успеха.

Женский онлайн-журнал https://gracefullady.kyiv.ua свежие статьи о моде, красоте, здоровье и саморазвитии. Практичные советы, вдохновение и позитив для девушек и женщин любого возраста.

https://hr.rivagroup.su/

Женский сайт https://family-site.com.ua современный портал о моде, красоте, отношениях и саморазвитии. Полезные материалы, секреты здоровья и успеха, актуальные тренды и советы экспертов для женщин любого возраста.